The 2020-21 Federal Budget is a road to recovery paved with cash.

Key initiatives include:

- Personal income tax cuts from 1 July 2020

- A $4 billion ‘JobMaker’ Hiring Credit to encourage businesses to take on additional employees aged 16 to 35 years old

- $110 billion in infrastructure investment over 10 years

- Immediate deductions for business investment in capital assets

- Changes to how companies can manage losses

- Access to generous tax concessions for a wider range of businesses

The Budget also contains two additional Economic Support payments to pensioners and other eligible recipients to drive money back into the economy.

By comparison to many, Australia has managed the COVID-19 pandemic well, but good management isn’t enough to protect us from the $213.7 billion deficit in 2020-21. The Government has taken to heart the old adage, “You have to spend money to make money” to trade our way out of a black hole.

Some of the measures are aimed at addressing the harsh lessons COVID-19 has taught us and seek to centralise production back in Australia to ensure our industries can be self-reliant.

Outside of the big ticket tax measures, what is striking about this Budget is the sheer volume of initiatives it funds – too many to itemise in this update. Many of the initiatives aim to improve how Government interacts with the community and business in particular. This funding is focussed on streamlining interaction and compliance with Government requirements and investing in the IT infrastructure required to digitise the compliance process.

The final comments in the Treasurer’s Budget speech paint a cautionary tale. The focus right now is on the path to growth and stabilising debt in an effort to boost consumer and business confidence. However, once “recovery has taken hold and the unemployment rate is on a clear path back to pre-crisis levels” of below 6%, the second phase will kick in – the deliberate shift from providing temporary and targeted support to stabilising debt.

Explore our budget review in more detail here:

The Regulators

- $104.9 million to AUSTRAC over four years from 2020-21 to strengthen its capacity to combat serious financial crime and to protect Australia’s financial system from criminal activities.

- $459.2 million over four years from 2020-21 to the CSIRO to address the impact of COVID-19 on its commercial activities

- $305.9 million additional funding to the Australian Taxation Office for the delivery of the next phase of the JobKeeper Payment and the JobMaker Hiring Credit

- $241.2 million for the Australian Bureau of Statistics to maintain Australia’s statistics gathering and analysis capabilities to better track Australia’s COVID-19 economic recovery

- $116.5 million for the Australian Competition and Consumer Commission (including capital funding of $32.9 million) to better protect consumers and small businesses

- $106.4 million for the Treasury to continue to implement the Government’s COVID-19 response and track economic recovery

- $28.8 million to the Australian Prudential Regulation Authority to boost its capacity to respond to risks within the financial system, with costs to be recovered from industry.

- $15 million in additional funding for serious and organised crime in the tax and superannuation system. This extends the 2017-18 Budget measure for another two years to 30 June 2023

The Economy

We knew there was going to be a big black hole of a deficit. The Treasurer revealed $213.7 billion in 2020-21, with an expectation of this falling to $66.9 billion by 2023-24.

Australia’s economy contracted by 7% in the June quarter.

Gross debt will increase to $872 billion (45% of GDP) this year and stabilise at around 55% of GDP in the medium term.

Net debt will increase to $703 billion (36% of GDP) this year before peaking at 44% of GDP in June 2024, and declining to less than 40% of GDP over the medium term.

GDP is forecast to fall by 3¾% this calendar year and the unemployment rate is forecast to peak at 8% in the December quarter. Next calendar year, GDP is forecast to grow by 4¼%, and the unemployment rate is forecast to fall to 6½% in the June quarter 2022.

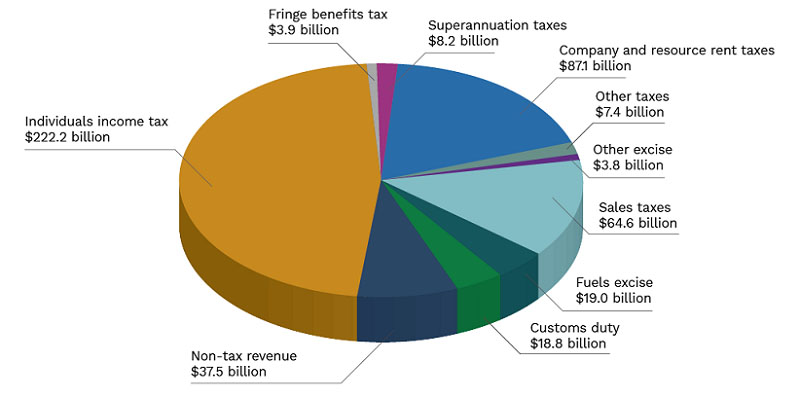

Where revenue comes from (2020-21)

Where money is spent (2020-21)

Source: 2020-21 Federal Budget Appendix B: Revenue and spending

Disclaimer

The information contained herein is provided on the understanding that it neither represents nor is intended to be advice or that the authors or distributor is engaged in rendering legal or professional advice. Whilst every care has been taken in its preparation no person should act specifically on the basis of the material contained herein. If assistance is required, professional advice should be obtained.

The material contained in the 2020-21 Budget Update should be used as a guide in conjunction with professional expertise and judgement. All responsibility for applications of the 2020-21 Budget Update and for the direct or indirect consequences of decisions based on the 2020-21 Budget Update rests with the user. Knowledge Shop Pty Ltd, Propeller Advisory directors and authors or any other person involved in the preparation and distribution of this guide, expressly disclaim all and any contractual, tortious or other form of liability to any person in respect of the 2020-21 Budget Update and any consequences arising from its use by any person in reliance upon the whole or any part of the contents of this guide.

Copyright © Knowledge Shop Pty Ltd. 7 October 2020

All rights reserved. No part of the 2020-21 Budget Update should be reproduced or utilised in any form or by any means, electronic or mechanical, including photocopying, recording or by information storage or retrieval system, other than specified without written permission from Knowledge Shop Pty Ltd.