Don’t let the relaxed summer holiday feeling distract you from your business lodgment responsibilities!

Lodgment and payment deadlines still apply, although you get a little extra time this quarter for your December obligations.

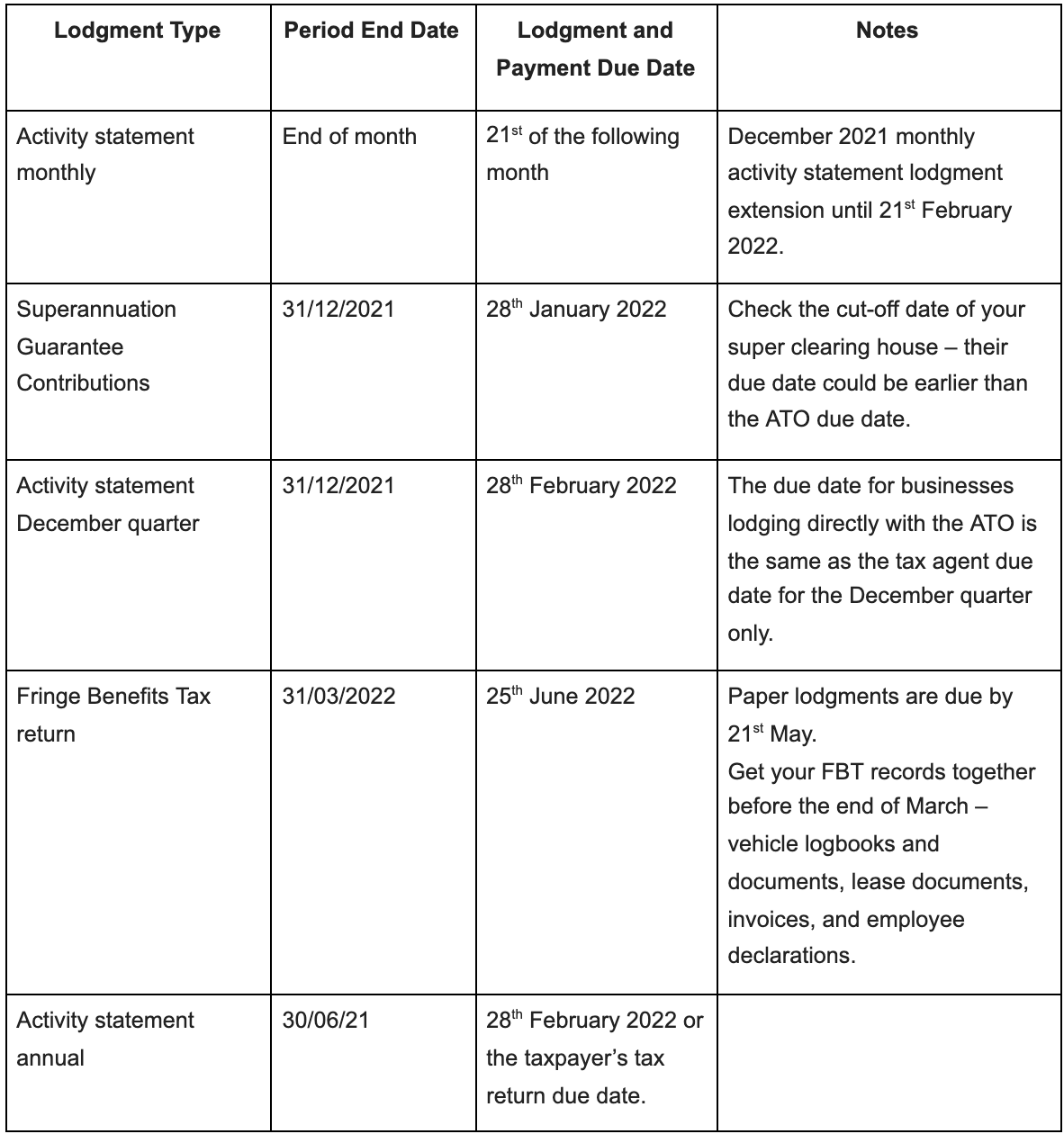

To help you get organised for the new year, we’ve highlighted some upcoming business lodgment due dates.

Talk to Us About Lodgment Planning

If we’re already lodging on your behalf, lodgment extensions automatically apply. You may have earlier deadlines if you’re lodging activity statements and other forms directly with the ATO. If you need more time to lodge and pay, let us know, and we can help you meet your obligations or arrange a lodgment extension if required.

Some tax return due dates fall within the first quarter of 2022 – talk to us if you’re not sure of your business entity’s tax return due date.

It’s good practice to plan for your lodgment dates, so you’re always ahead of the ATO and also for your cash flow planning. Don’t get caught out with a penalty for late lodgment!