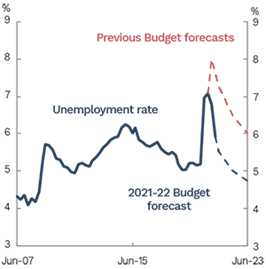

In his Budget speech, the Treasurer stated “Australia is coming back” with unemployment lower than pre pandemic levels (5.6%).

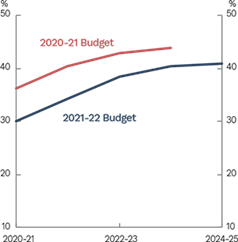

The deficit, thanks in part to surging iron ore prices, is lower than anticipated in the 2020-21 Federal Budget at $161 billion in 2020-21, a $52.7 billion improvement to estimates. The underlying cash balance is expected to be a deficit of $106.6 billion in 2021-22 and continue to improve over the forward estimates to a deficit of $57 billion in 2024-25. While the deficit is large, it did its job.

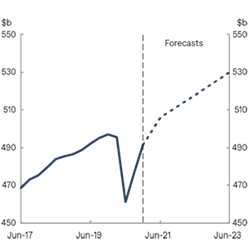

Real GDP grew strongly over the latter half of 2020, marking the first time on record when Australia has experienced two consecutive quarters of economic growth above 3% – output is expected to have exceeded its pre-pandemic level in the March quarter of 2021. Real GDP is forecast to grow by 1.25% in 2020-21, by 4.25% in 2021-22 and 2.5% in 2022-23. After falling by 2.5% in 2020, real GDP is expected to grow by 5.25% in 2021, and by 2.75% in 2022.

Key budget assumptions

A population-wide vaccination program is likely to be in place by the end of 2021.

- During 2021, localised outbreaks of COVID-19 are assumed to occur but are effectively contained.

- General social distancing restrictions and hygiene practices will continue until medical advice recommends removing them.

- No extended or sustained state border restrictions in place over the forecast period.

- A gradual return of temporary and permanent migrants from mid-2022. Small phased programs for international students will commence in late 2021 and gradually increase from 2022. The rate of international arrivals will continue to be constrained by state and territory quarantine caps over 2021 and the first half of 2022, with the exception of passengers from Safe Travel Zones.

- Inbound and outbound international travel is expected to remain low through to mid-2022, after which a gradual recovery in international tourism is assumed to occur.

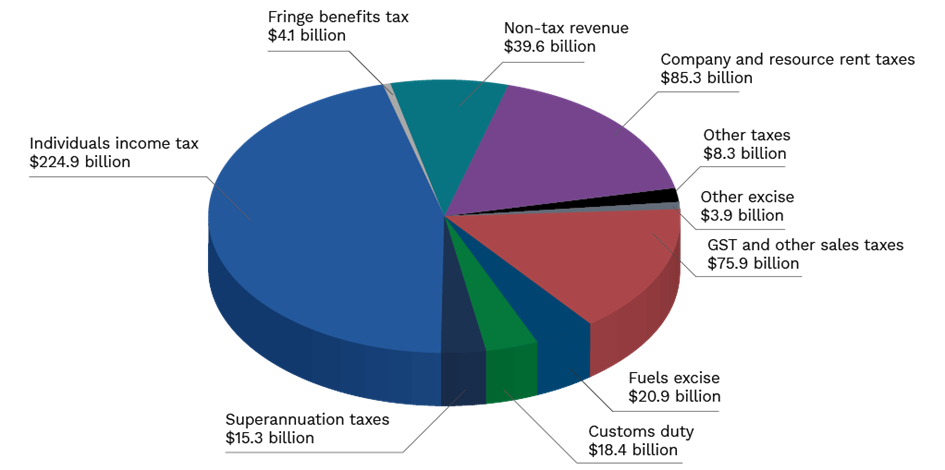

Revenue: Where 2021-22 Budget revenue comes from

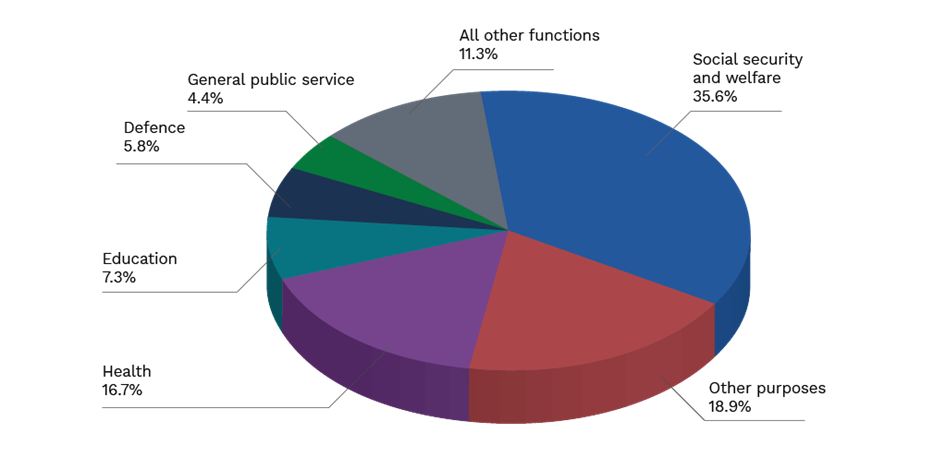

Expenditure: How the 2021-22 Budget is spent

The information contained herein is provided on the understanding that it neither represents nor is intended to be advice or that the authors or distributor is engaged in rendering legal or professional advice. Whilst every care has been taken in its preparation no person should act specifically on the basis of the material contained herein. If assistance is required, professional advice should be obtained. The material contained in the Budget 2021-22 Update should be used as a guide in conjunction with professional expertise and judgement. All responsibility for applications of the Budget 2021-22 Update and for the direct or indirect consequences of decisions based on the Budget 2021-22 Update rests with the user. Knowledge Shop Pty Ltd, Propeller Advisory Pty Ltd, directors and authors or any other person involved in the preparation and distribution of this guide, expressly disclaim all and any contractual, tortious or other form of liability to any person in respect of the Budget 2021-22 Update and any consequences arising from its use by any person in reliance upon the whole or any part of the contents of this guide. Copyright © Knowledge Shop Pty Ltd. 12 May 2021. All rights reserved. No part of the Budget 2021-22 Budget should be reproduced or utilised in any form or by any means, electronic or mechanical, including photocopying, recording or by information storage or retrieval system, other than specified without written permission from Knowledge Shop Pty Ltd.